If you have $USDC debt on @base, you are loosing money if you are not on @aave

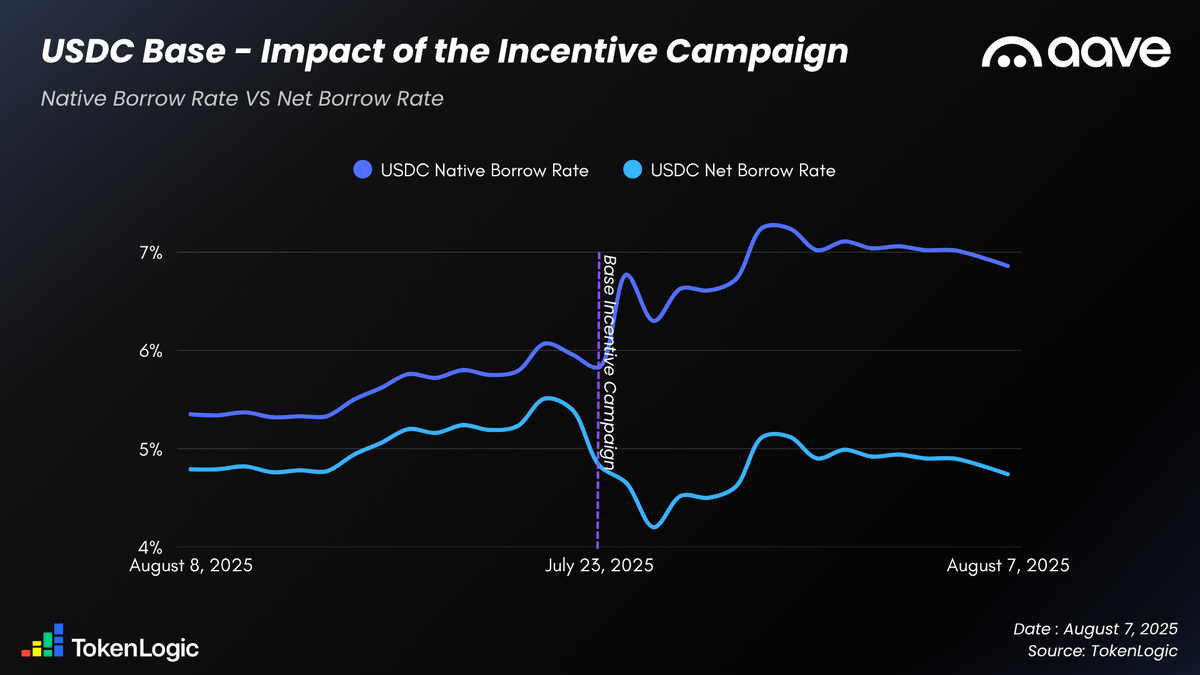

Now that the Incentive Campaign has been live since July 23, let’s take a closer look at how $USDC borrowing costs changed.

Quick reminder:

→ Native Borrow Rate = Borrow APY

→ Net Borrow Rate = Borrow APY - Incentives APR

As shown on the chart, both rates moved closely together before the campaign launched.

After July 23, the native borrow rate started rising, while the net borrow rate dropped below pre-campaign levels.

► The result?

Despite higher native rates, users are now paying less to borrow $USDC thanks to the Base Incentive Campaign.

1.47K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.