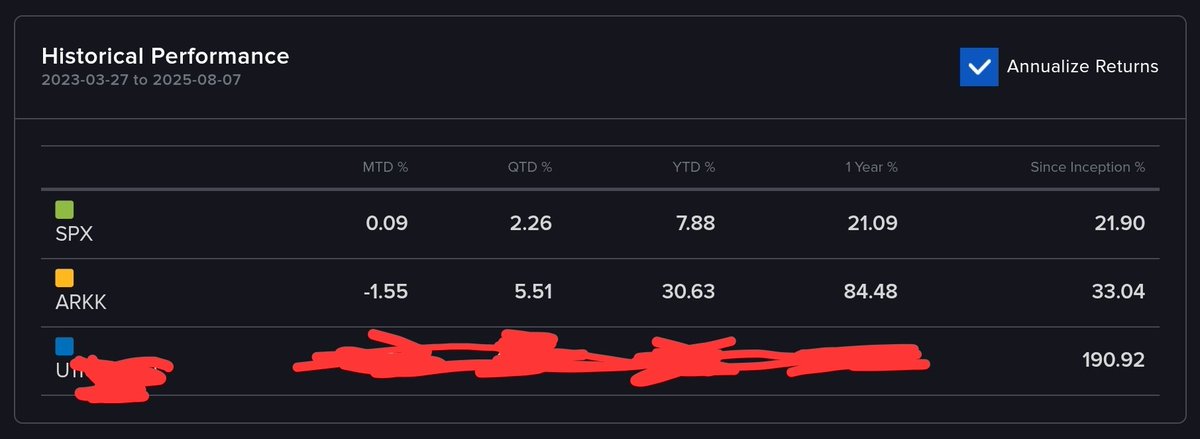

My annualized returns since switching to Interactive Brokers in early 23 are bonkers: 190.92% 🤯

I only own common shares. The market is simply ridiculously inefficient because it is made up of emotional people.

Sometimes, I daydream about what might be necessary to train Lemonade's AI investor to beat Warren Buffett's Geico float returns, but for thousands of years instead of a single lifetime.

We have enough wise investment knowledge today. The problem is that AI today is trained on too much noise to be very useful as an investment manager.

Education textbooks on investing are terrible, and Wallstreet sucks at investing. AI must ONLY be trained on the writing of investors who destroyed the market to have any hope of outperformance itself.

I also switch to IBKR at an opportunistic low in the market. 😂 My lifetime returns since I started investing are a bit lower.

In total, it took me ~6 years from when I started investing to 100x. This includes investing through the Covid crash and a few others in my companies.

Shortly after I started investing, I went all in on $TSLA before it 20x'd. That is a kind of supercharge that is extremely rare, and the timing of it all was a large amount of luck. All that happened on M1 Finance, though, and unfortunately doesn't show above.

If you want to learn how to invest, I highly recommend what I did. Drop out of college and stop overpaying to feed your brain with noise that teaches how to do average. (RIP the first $15K I ever saved from my High School YouTube channel) and instead decide that you're okay to lose that money to ACTUALLY learn investing.

2nd. Create a list of the 25 best investors of the past 100 years. By best, I mean those who actually got the highest returns. NOT BEST SELLERS. Really research this. If you can't do good research here, you'll never research well enough later to pick good stocks.

3rd. Find out which of these investors wrote books. Not all did, unfortunately. And ONLY listen to the advice from these books. Read it over and over. Let the advice replace all your other perceptions. Anything anyone told you who hasn't gotten good returns over a lifetime. IGNORE. Enough people have proved themselves over entire lifetimes to not have to listen to anyone alive today about how to invest. Love people who don't know how to build wealth, but get their investing advice out of your very conscience.

Lynch and Buffett are both great. Graham and Fisher also share valuable wisdom, but I've honestly treated One Up on Wallstreet by Peter Lynch like my investment Bible.

Except I changed one thing. I only let myself own my top few ideas at once. If Lynch had done this instead of owning hundreds of stocks, he would have done far better than his legendary 29% return annually.

If only owning a few companies seems risky to you, it's because you haven't done enough research to understand the story, risks, and valuation well enough. Many small business owners are entirely dependent on one business. I'm all in $LMND today because the asymmetry is greater than any other stock I understand deeply.

5.79K

50

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.