Rising US Inflation Could Delay Cuts, Crypto Sector at Risk?

Bitcoin had just made a new high. Ethereum was above $4,000. Traders expected interest rate cuts in September. But now, the U.S. inflation data is rising again, and that could change everything.

The part of the crypto market is being hit hardest? Meme coins. Time to understand how and why!

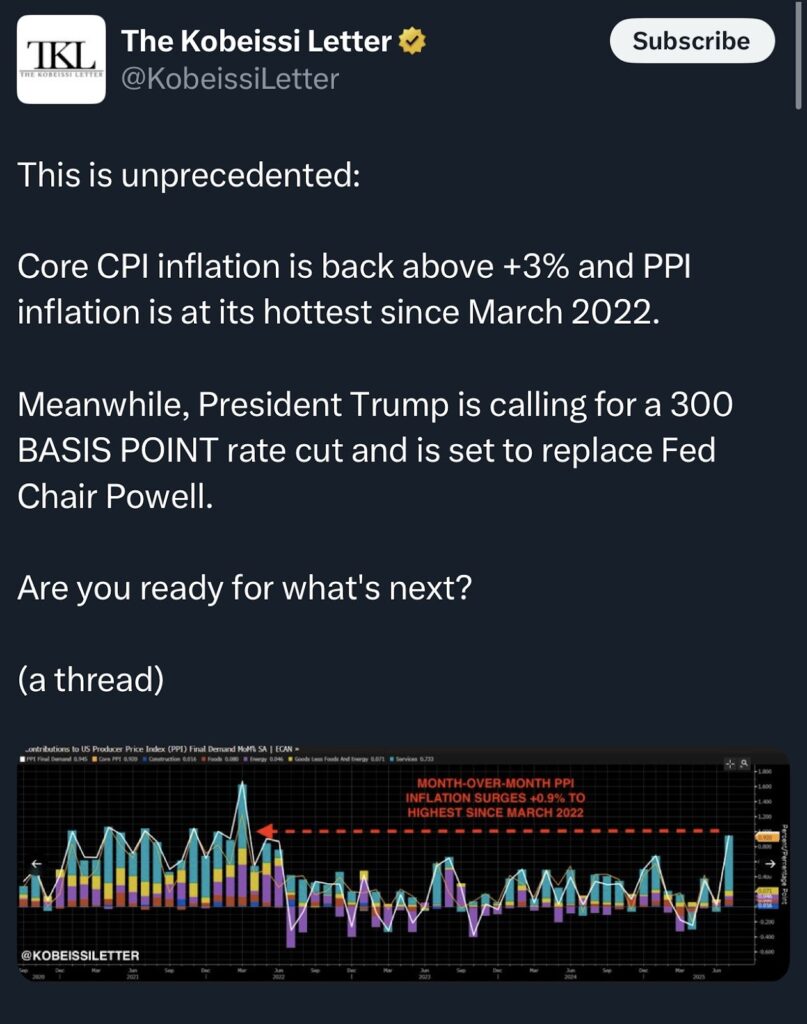

US Inflation Soars, Dampening Market Hopes

The new Producer Price Index (PPI) came out this week. It tells us how much prices are rising for businesses before products reach consumers.

In July, PPI rose by 0.9% in one month. That’s a big jump. Last month, it was just 0.2%. Over the last year, it’s now at 3.3%, which is the highest since early 2023.

That makes investors nervous. If prices keep rising, the U.S. central bank (called the Federal Reserve) might not lower interest rates soon.

And rate cuts are what many crypto traders were hoping for. Rate cuts help traders get access to more funds, which then go into the risk-on assets.

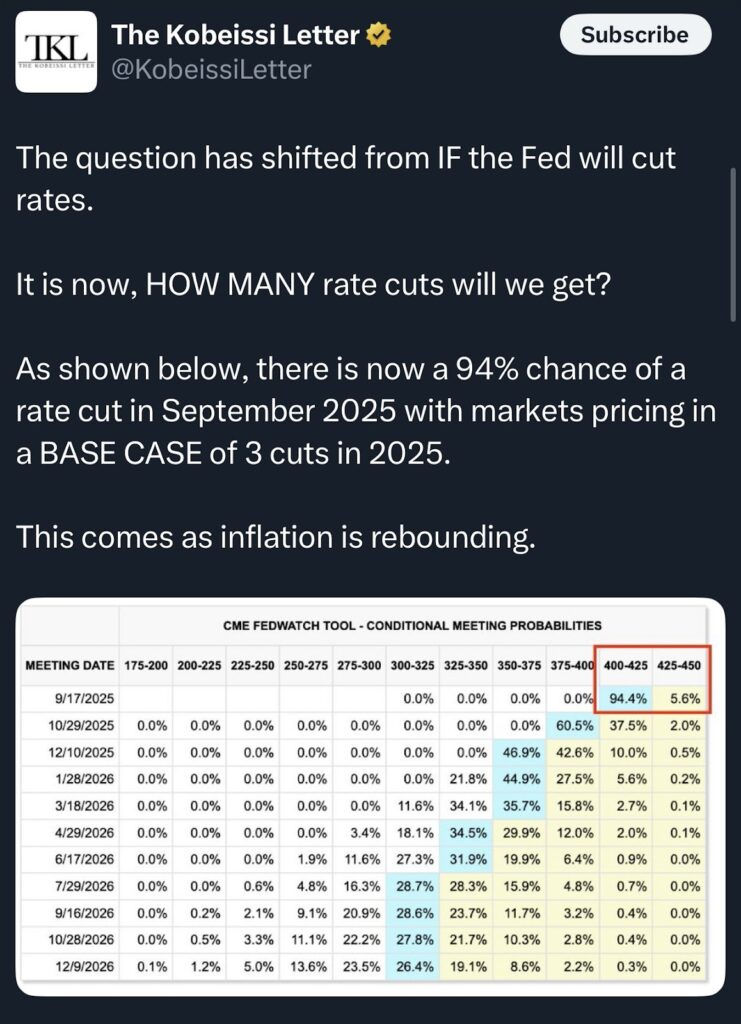

Despite the new PPI data, the chances of rate cuts in September remain high. However, with expectations from the retail and the crypto community slowing down, there might be a trend shift.

This kind of shift hits risk assets first, and meme coins fall into that group.

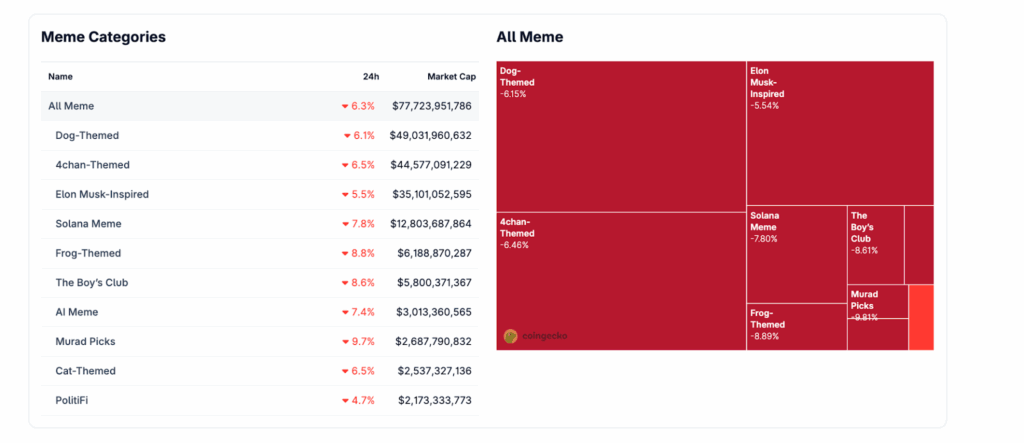

Meme Coins Are Dropping Fast

Within 24 hours of the inflation data, top meme coins fell hard:

- PEPE, Floki, and Shiba Inu all dropped by 7.5% to 11%.

- These weren’t small dips; it was fast and sharp.

- Other major coins like ETH and BTC held stronger despite the dips.

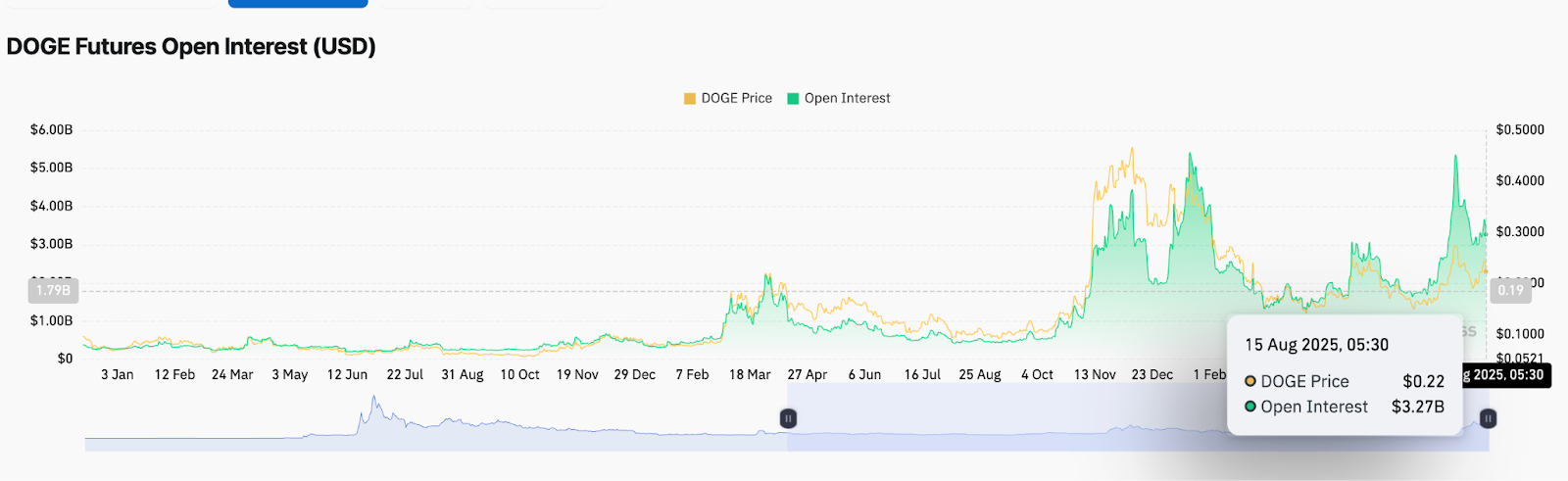

Open Interest (OI) on meme coin futures dropped by around $350 million. Open interest means the total number of active contracts.

When that number goes down, it usually means traders are closing positions. This shows they are stepping back, not jumping in.

More Meme Coins Are Moving to Exchanges

Data from major crypto exchanges shows something else: more meme coins are being sent to exchange wallets.

That usually means holders plan to sell. On-chain tracking tools saw this behavior increase soon after the inflation data dropped.

In simple words, holders are getting out, not doubling down.

At the same time, we’re not seeing a large move in USDC or Tether yet. Yes, exchange stablecoin reserves are growing, but the meme coin inflows show that gunpowder is moving elsewhere.

That means traders are not completely leaving crypto. They’re just moving from risky coins to safer ones. That often happens when the market is nervous.

No Signs of Recovery Yet

Usually, after a big drop in meme coins, traders try to “buy the dip.” But that’s not happening now.

Prices fell. Open interest dropped. But there was no strong bounce. That shows traders are still cautious. They’re closing trades and not opening new ones.

Even in other altcoin sectors, like gaming or AI tokens, we didn’t see heavy selling like this. Meme coins are clearly the weakest group right now.

The Big Problem: The Fed Might Wait Longer

The crypto community was expecting the Fed to cut rates in September. Lower interest rates usually help crypto. But with inflation now rising again, that timeline may be pushed to late 2024 or even 2025.

Higher rates make it harder for risky assets to grow. Meme coins, which are often driven by hype and social media, need strong momentum. Without easy money and strong demand, they lose steam fast.

Inflation is rising. The chances of rate cuts this year are going down. And meme coins are already paying the price.

The market is not crashing, but one part of it is clearly struggling. Until there’s better news on inflation or rate cuts, meme coins may keep dropping or stay flat.

This is not panic yet. But it is a clear sign: traders are being more careful, and meme coins are the first to suffer due to the rise in U.S. inflation.

The post Rising US Inflation Could Delay Cuts, Crypto Sector at Risk? appeared first on The Coin Republic.