Is @Aptos quietly building something big?

There are rumors that the team is quietly revamping everything with precision — preparing for the next big cycle. And there’s one area where we can clearly see their progress:

🧵A thread

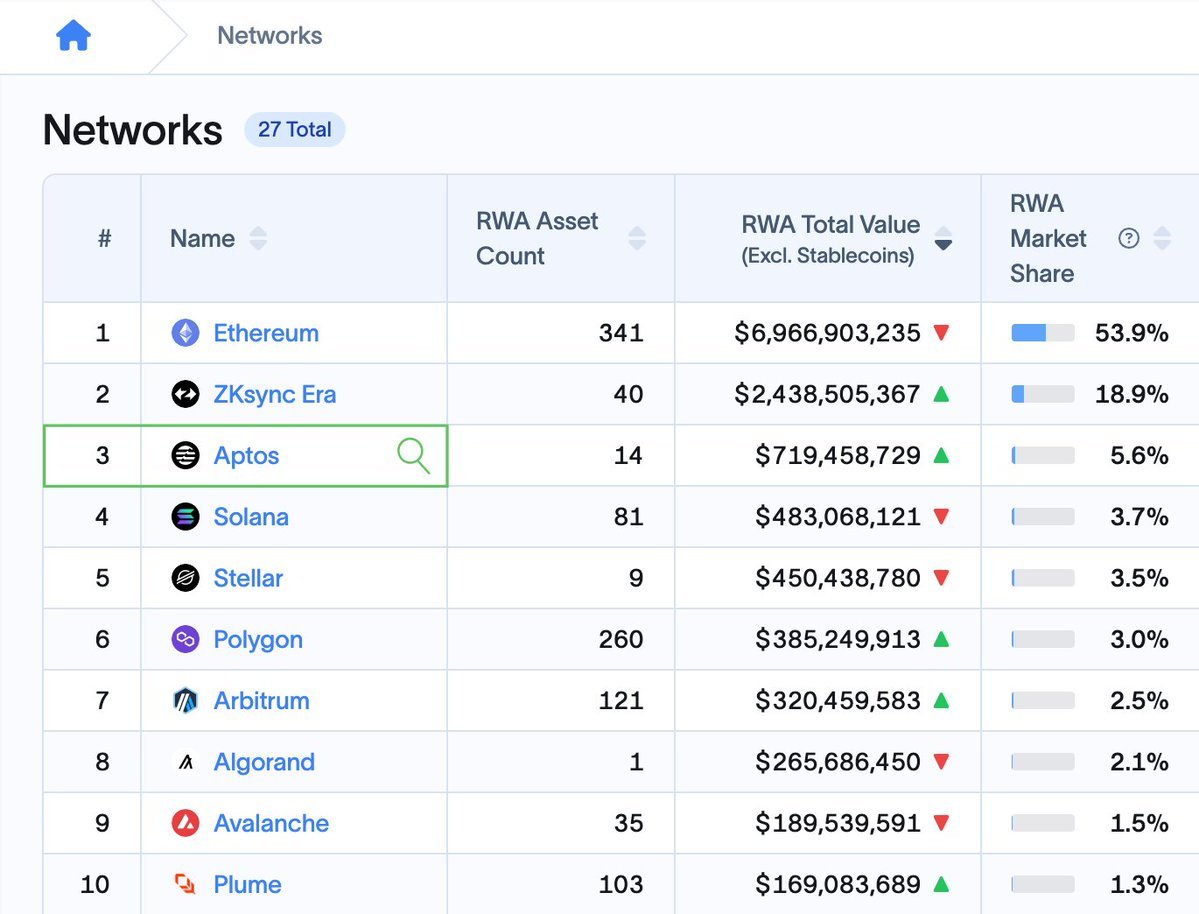

Aptos TVL in RWA has now surpassed $700M, ranking #3 overall, only behind Ethereum and zkSync Era.

This growth wouldn’t be possible without the support of major partners like:

@pactconsortium @OndoFinance @BlackRock @Securitize @apolloglobal @FTDA_US @KAIO_xyz

1. @BlackRock – BUIDL Fund

BlackRock’s BUIDL Fund is the first and largest tokenized U.S. liquidity fund on public blockchains. Since late 2024, it has expanded to Aptos to issue RWA products.

👉 Support: Issuing tokenized representations of the fund, allowing users to invest and trade on-chain via Aptos.

2. @FTI_US (Franklin Templeton) – BENJI Fund

Franklin Templeton’s “OnChain U.S. Government Money Fund” (FOBXX), tokenized as BENJI, is a tokenized money market fund now live on Aptos. It enables institutional-grade on-chain investment in U.S. Treasuries.

👉 Support: Tokenizing treasury-backed money market funds, enabling fractional ownership and on-chain settlement.

3. @Securitize – Apollo ACRED Fund

Securitize, in partnership with Apollo Global, tokenized the ACRED Fund (private credit) and issued it on Aptos. Securitize provides regulatory-compliant issuance, transfer agent services, and identity verification.

👉 Support: Tokenizing private credit funds and offering full regulatory infrastructure on Aptos.

4. @pactconsortium (Berkeley Square Consortium)

PACT Protocol, launched by the Berkeley Square Consortium, is the largest issuer of RWA on Aptos, contributing over $300M in RWA TVL with 7 active products.

👉 Support: On-chain issuance and management of credit products, collateralized debt, and fixed-income RWAs.

5. Libre Capital & @OndoFinance

Libre Capital provides private credit and money market products on Aptos.

Ondo Finance issues yield-bearing tokens like USDY, backed by short-term U.S. Treasuries.

👉 Support: Tokenizing real-world fixed-income instruments for retail and institutional DeFi investors on Aptos.

@Aptos

@pactconsortium @OndoFinance @BlackRock @Securitize @apolloglobal @FTDA_US @KAIO_xyz passed $700M in tokenized RWAs.

71.34K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.