$ALLO Valuation Range based on Allora Peer FDVs

Allora is an open machine learning network focused on predictive intelligence and inspired by Bittensor ("darwinian AI") and Chainlink (high-quality data feeds).

It enables competitive, crypto-economically incentivized ML algo optimization through a unique network architecture that results in accurate and context-aware, predictive data feeds that can be leveraged by agents and built into DeFi protocols.

Valuation Comparables:

➤ Bittensor ($7.2B FDV): Decentralized AI/ML network that provides crypto-economic incentive structure for a Darwinian" ecosystem where miners on subnets compete on optimizing algorithms / producing a "digital commodity", with the latter potentially being serverless compute, decentralized storage, distributed model training, verifiable inference, computer vision, predictive intelligence, and more.

➤ On Bittensor, there is also a bunch of predictive intelligence focused subnets, which are often narrowly focused on a specific type of data/prediction.

This includes:

- SN6 Infinite Games $33M

- SN8 Taoshi $328M

- SN18 Zeus $25M

- SN41 Sportstensor $53M

- SN44 Score $223M

- SN50 Synth Data (by Mode) $44M

- SN55 Coinmetrics (precog) $17M

Collectively, these predictive intelligence subnets on Bittensor are currently valued at $723M.

➤ Flock ($162M FDV): Flock is a competitive AI marketplace platform inspired by Bittensor where participants compete across various tasks from training models and providing intelligence to offering trading signals and predictions. The platform leverages competition as its core mechanism to create the best base models + federated learning/fine-tuning for domain-specific use cases, etc.

➤ The Innovation Game ($167M FDV): The Innovation Game is a decentralized network that is designed to accelerate algorithmic innovation, turning these algorithms into liquid, investable onchain assets. TIG uniquely replaces traditional PoW mining with Optimisable Proof of Work (OPOW), incentivizing computationally valuable scientific breakthroughs. Researchers simply submit algorithms, with rewards directly tied to real-world adoption and measurable performance. Finally, commercial licensing creates a sustainable economic loop, linking algorithm adoption directly to TIG token value.

➤ Oracles: While not directly competitive on the product, the concept of providing data feeds to integrating protocols (just realtime/historical vs predictive) remains similar. This category includes players like Chainlink (16.7B FDV), Redstone ($400M FDV) or Pyth ($1.2B FDV), which are among the current market leaders with a live token.

While similarities with all of the above players exist, it's also important to point out tho, that inferring a valuation directly from this remains difficult, and highly speculative.

The Bottom Line:

Personally, I think from a tech perspective, the TAO subnets are likely the best comparable, even though a singular subnet might not do justice to Allora's Bittensor-style architecture (with various prediction "topics") and broad adoption (among agents, the frameworks they are built on and DeF(a)i protocols.

Hence, as an upper range ceiling, we might consider the entirety of prediction-focused Bittensor subnets, while the standalone valuation of a more established subnet (e.g. Taoshi and Score) or algo innovation network like Flock and TIG.

Oracles are less relevant as a comparable here imo, but alongside the TAO FDV can provide a reference of where the journey can go in the long term if the network continues to grow and find meaningful adoption.

Based on the comparable analysis, a reasonable TGE FDV range for $ALLO would be:

➤ Bear Case: $150-250M (aligned with standalone, early-stage algo innovation networks like Flock or TIG)

➤ Base Case: $250-500M (comparable to established prediction subnets like Taoshi/Score or mid-sized oracle players like Redstone)

➤ Bull Case: $500-750M (capturing Allora's multi-topic network potential vs. single-subnet focus and its adoption, approaching the collective predicition subnet valuation)

Don't think we'll see anything beyond $1B FDV off the bat, but given the strong technical niche and clearly identified niche Allora has positioned itself in (with decent adoption levels already), the project could justify valuations toward the higher end over time for sure.

In any case, highly recommended to DYOR on this one anon.

Looking for more information on Allora?

Check my post below!

Allora: The Self-Improving Open Intelligence Network

Today, powerful machine intelligence is concentrated within a few industry giants, creating silos that isolate valuable data, algorithms, and computational resources. Allora dismantles these barriers by creating a decentralized, open-access network where these components can seamlessly interconnect and collaborate.

@AlloraNetwork aggregates specialized machine learning models to generate superior, context-aware predictions. This positions Allora as a crucial infrastructure layer for agents and DeFAI protocols, providing the (predictive) intelligence that autonomous agents and powerful DeFAI apps require for smarter, more effective decision-making.

➀ Key Mechanics

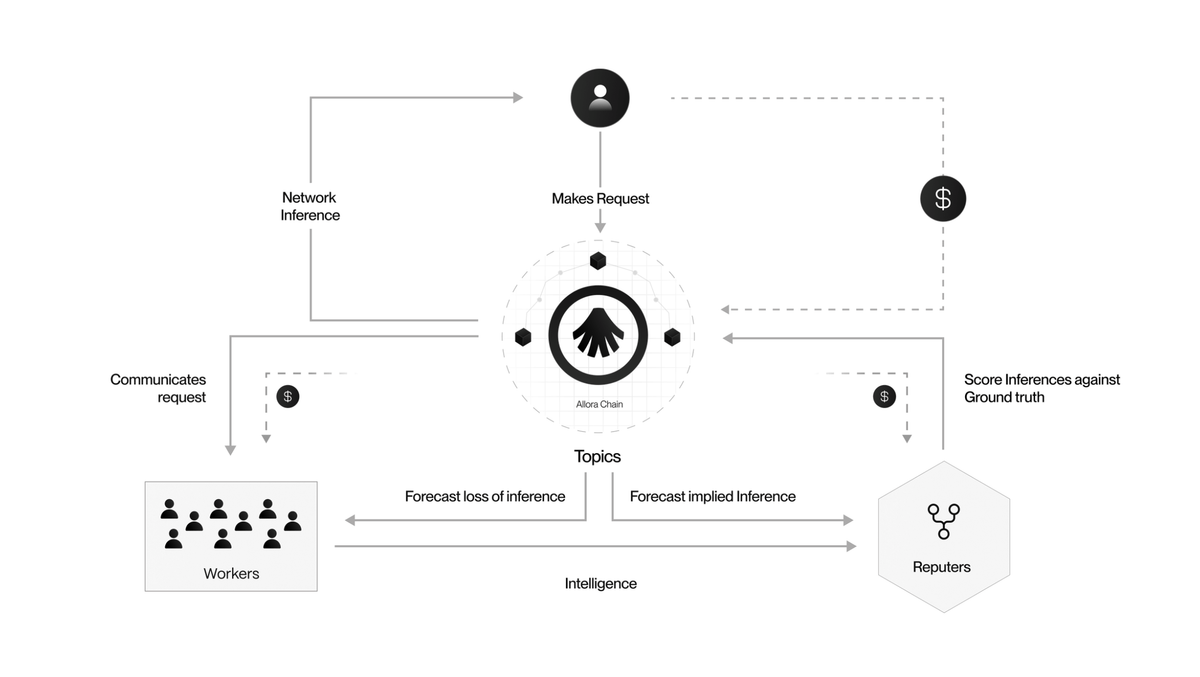

➤ Inference aggregation system:

1 ) Topic coordinators define prediction tasks

2 ) Worker nodes submit model inferences

3 ) Reputer nodes evaluate accuracy against ground truth

4 ) Network weighs & combines outputs based on historical performance

➤ Allora's abstraction layer for collaborative AI is built around an "objective-centric" architecture, which means users specify desired ML outcomes rather than selecting models; network dynamically routes to optimal model combinations

➤ Economic alignment is ensured as ontributors earn rewards proportional to inference quality, creating competitive model improvement dynamics

➁ Traction Metrics

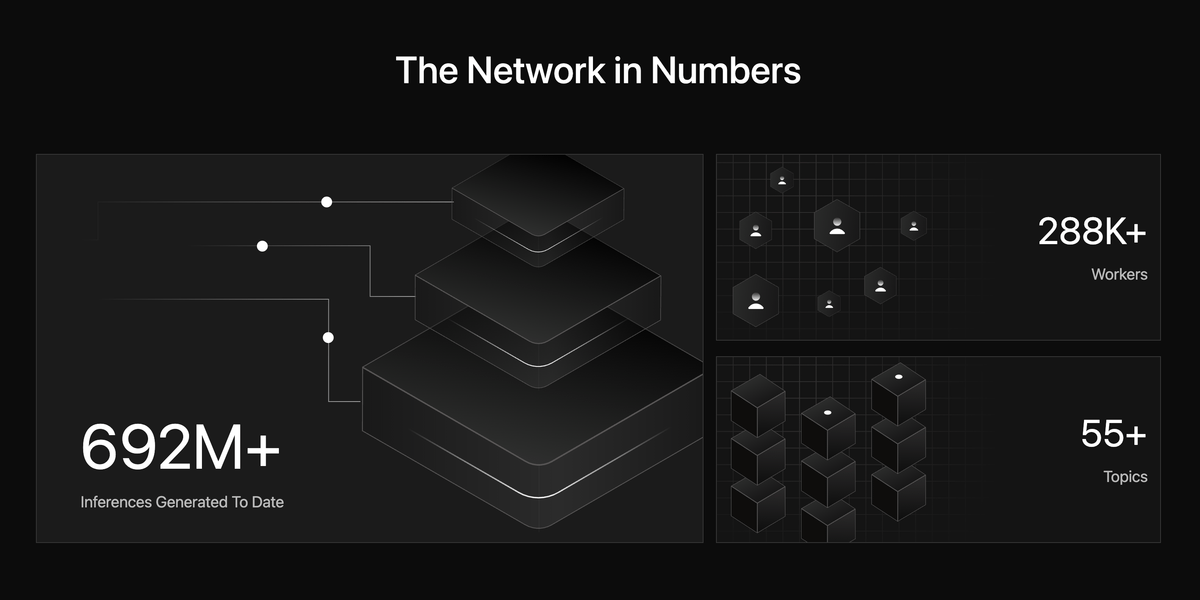

- 692M+ inferences generated

- 288K+ workers (likely inflated by testnet incentives)

- 55+ prediction topics

➂ Primary Use Cases

➤ Predictive price feeds: AI-powered asset price forecasting for DeFi protocols

➤ Automated liquidity management: Dynamic rebalancing based on market predictions

➤ Yield optimization: Adaptive leverage and compounding strategies

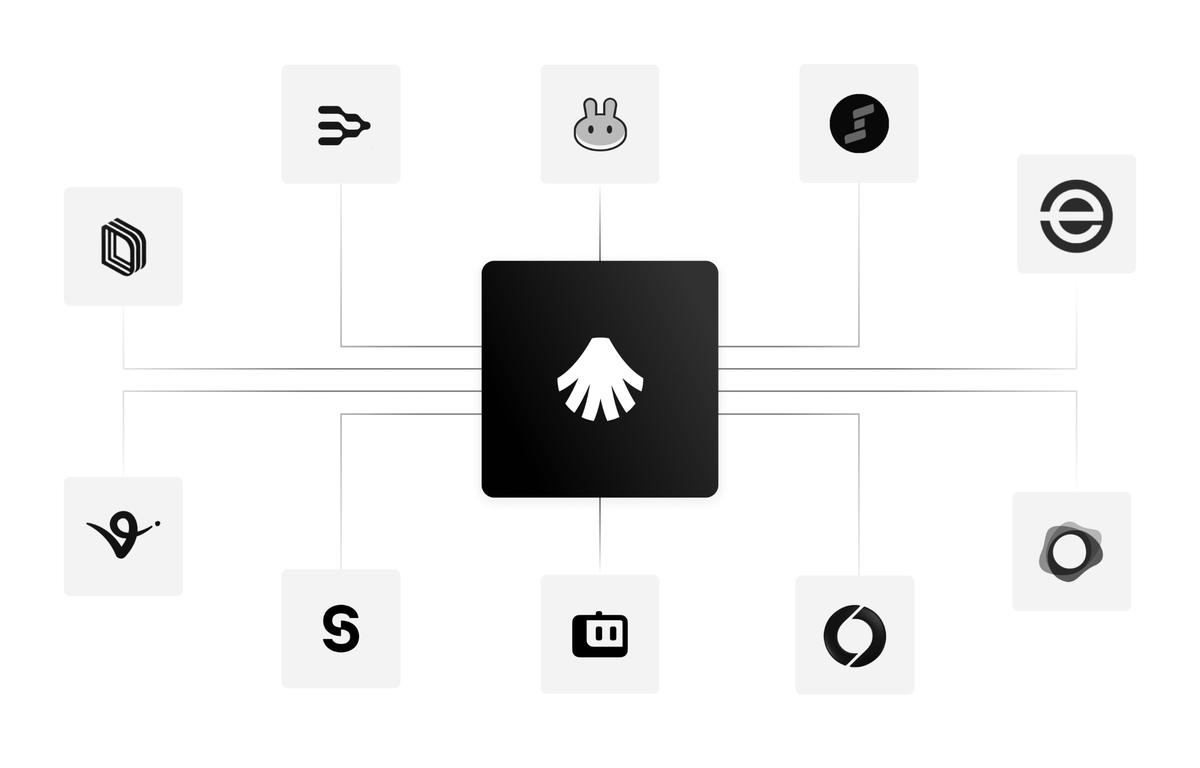

➃ Live Integrations

- Coinbase CDP (AgentKit)

- Pancakeswap (price predictions)

- Steer Protocol AI-powered vaults)

- Drift (perps strategies)

- Ember AI (agent kit on Arbitrum)

- Vectis (AI-powered USDC vaults

- Cod3xO (agent platform)

- Axal (yield farming)

- BrahmaFi (autonomous capital management)

- ElizaOS (agent framework/launchpad)

- CreatorBid (agent framework/launchpad)

- Virtuals (agent framework/launchpad)

- Many more

➄ Key Takeaways

Allora targets a real pain point in the DeFAI space, as protocols and agents need much more advanced and better predictive capabilities than simple price oracles can provide.

Allora's "darwinian" approach to ML model composition and open development/optimization of predictive ML/AI models seems to hence have a clear PMF for price/volatility forecasting, which is evidenced by the actual protocol integrations that go beyond mere pilot projects. However, Allora is not the only player in this vertical, and there are for example also various subnets on Bittensor, that follow a similar objective, as well as centralized competitors.

The long-term success of Allora's more specialized, more narrowly focused Bittensor-style network will hinge on the prediction accuracy and network performance outperforming both centralized and decentralized alternatives, and its continued ability to capture market share in the growing agent/DeFAI market verticals.

With its current mindshare traction (also accelerated by its Kaito LB campaign) and the upcoming mainnet launch + TGE (likely this month), there will likely be a lot of eyes on Allora in the weeks to come.

DYOR anon.

5.18K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.