After looking at the data analysis from @HouseofChimera, I have some thoughts.

@MMTFinance, as the largest DEX in the Sui ecosystem, has recently shown excellent capital efficiency and revenue models, and it hasn't even issued a token yet.

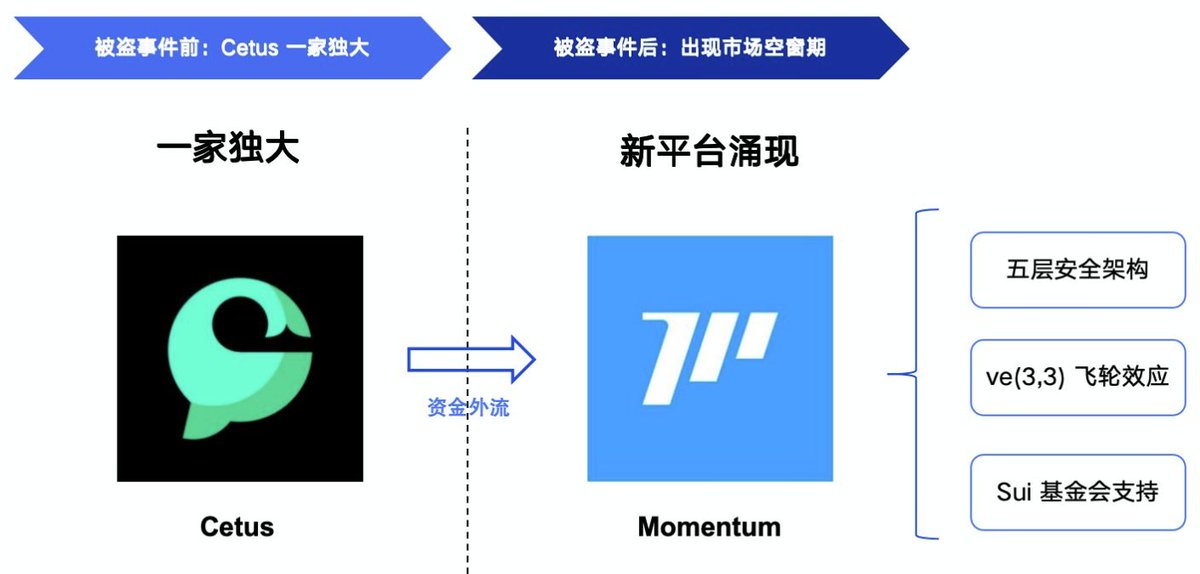

Many people compare it to Cetus, but there are some differences.

1️⃣ Differences on the asset side

Curve → Focuses on stablecoins and LSD, more like a "high-efficiency exchange for similar assets," suitable for low-slippage swaps.

Momentum → Based on the CLMM model of Sui, covering a wider range of trading pairs (not limited to stablecoins), with higher capital efficiency.

👉 In simple terms, Curve leans towards stability, while Momentum leans towards efficiency and flexibility.

2️⃣ Different revenue models

Curve → Trading fees mainly go to liquidity providers (LPs), with limited protocol revenue; many earnings rely on external "bribes" + "ecosystem subsidies".

Momentum → Adopts the ve(3,3) model, where a fixed proportion of all trading fees goes directly to veMMT stakers, creating "real yield" native to the protocol, rather than relying on inflation or external subsidies.

👉 Curve needs external protocols to drive the flywheel, while Momentum has a stronger internal flywheel.

3️⃣ Governance and incentive mechanisms

Curve → veCRV model, long-term staking for governance rights + rewards, but the staking period lasts up to 4 years, with a high entry threshold.

Momentum → ve(3,3) mechanism + Sui ecosystem bonuses, with more flexible governance and reward cycles, high capital utilization, and easier community participation.

👉 Curve is more focused on long-term institutional governance, while Momentum is more community-friendly.

4️⃣ Network and ecosystem differences

Curve → Already a foundational infrastructure for Ethereum and multi-chain, with a large user base, stable but highly competitive.

Momentum → Completely tied to the Sui ecosystem, playing a core role on the emerging public chain, with both risks and opportunities.

👉 Curve is a cross-chain giant, while Momentum is the native core DEX of Sui.

5️⃣ Different growth logic

Curve → Growth relies on the expansion of the stablecoin market + the LSD sector.

Momentum → Growth relies on the overall expansion of the Sui ecosystem + the attractiveness brought by CLMM trading efficiency.

👉 Curve is more like the underlying trading foundation of interest rate protocols, while Momentum is the liquidity engine for the growth of new public chains.

Since the trust in Curve has been damaged due to the theft incident, the future growth potential of @MMTFinance is gradually being validated, and we can look forward to it.

.@MMTFinance has been on a steady climb, and the numbers back it up:

🔹 $165M TVL

🔸 $35.15M annualized fees

🔹 $7.01M annualized revenue

🔸 $2.36B DEX volume (30d)

🔹 $10M raised

Momentum is building, and it’s not slowing down.

16.17K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.