Teller Yields Weekly Digest – August 7, 2025

A snapshot of the latest lending markets on @useteller.

Top $USDC lending pools on Ethereum this week.

APYs range from 26% to over 43%. 🧵

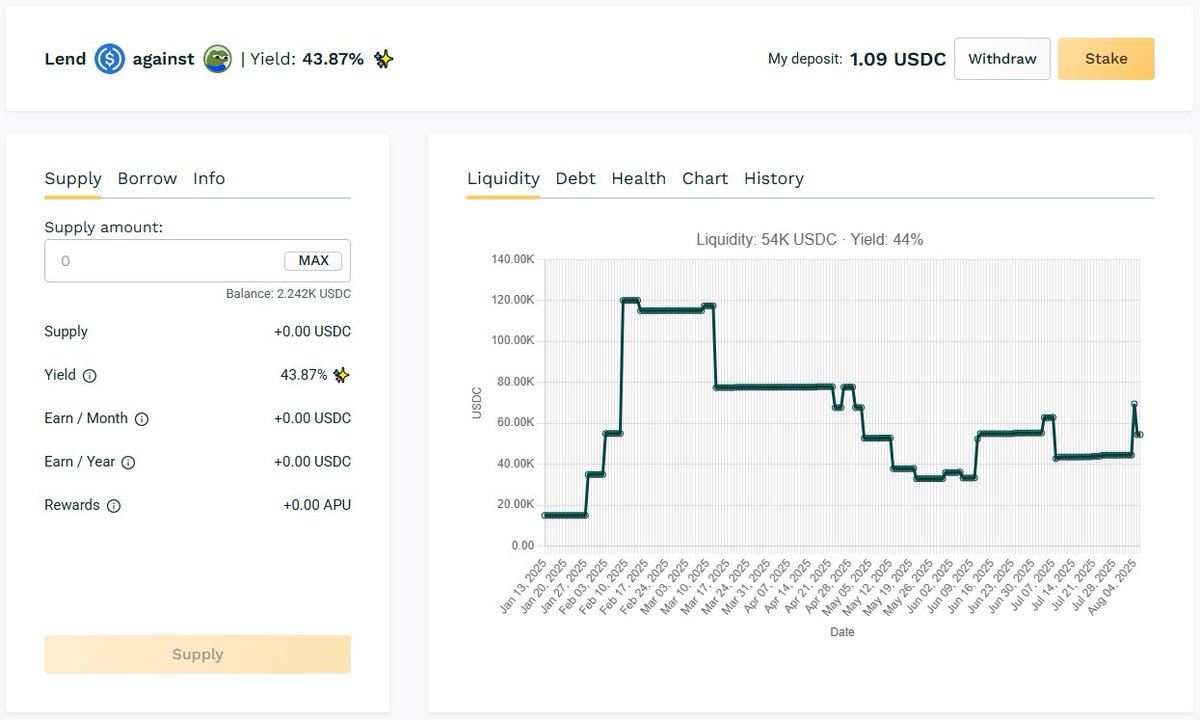

1️⃣ USDC / $APU

🧮 APY: 43.87%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Frequent 30‑day loan rollovers kept APU above 40% APY. Meme‑token borrowers remain active.

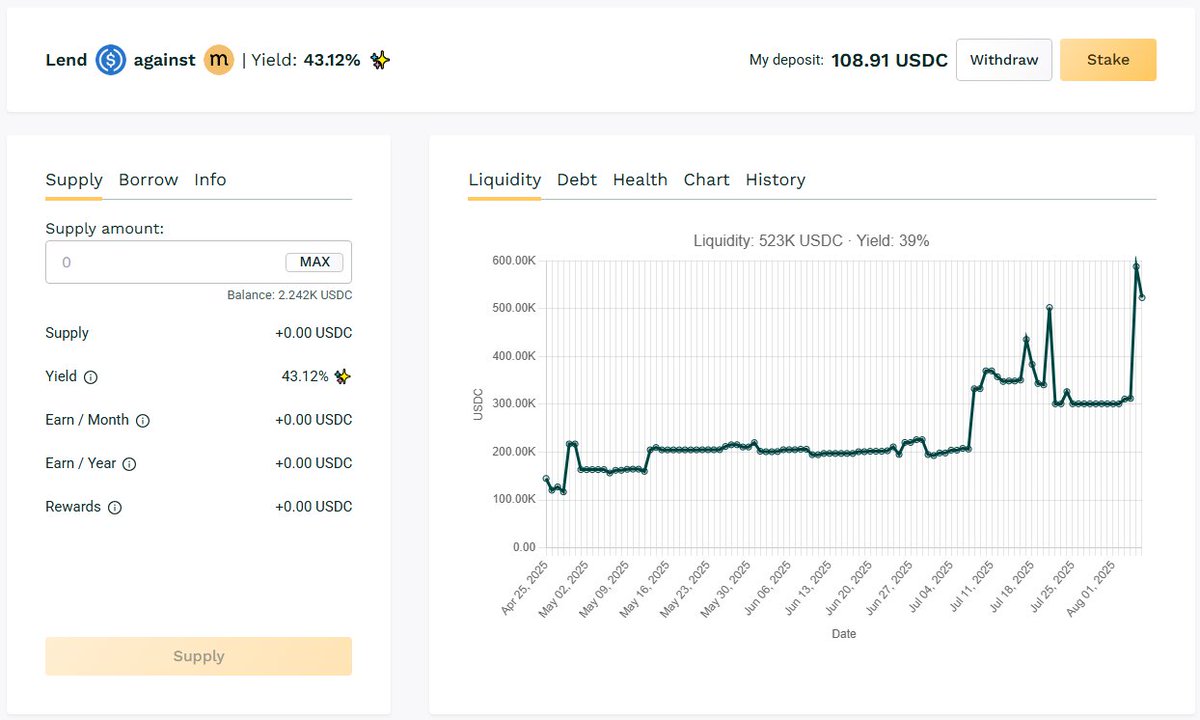

2️⃣ USDC / $MASA

🧮 APY: 43.12%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Borrowing demand is consistent, pushing utilisation high and APY above 43%.

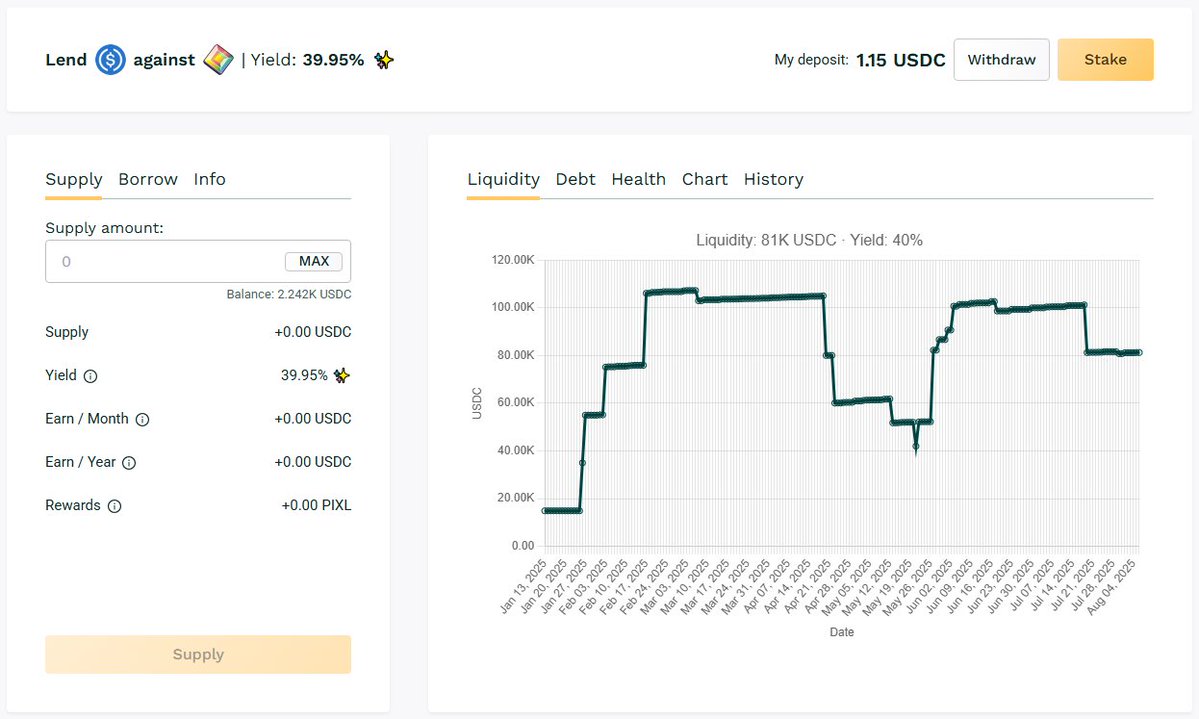

3️⃣ USDC / $PIXL

🧮 APY: 39.95%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Short-duration lending with active turnover drove APR near 40%.

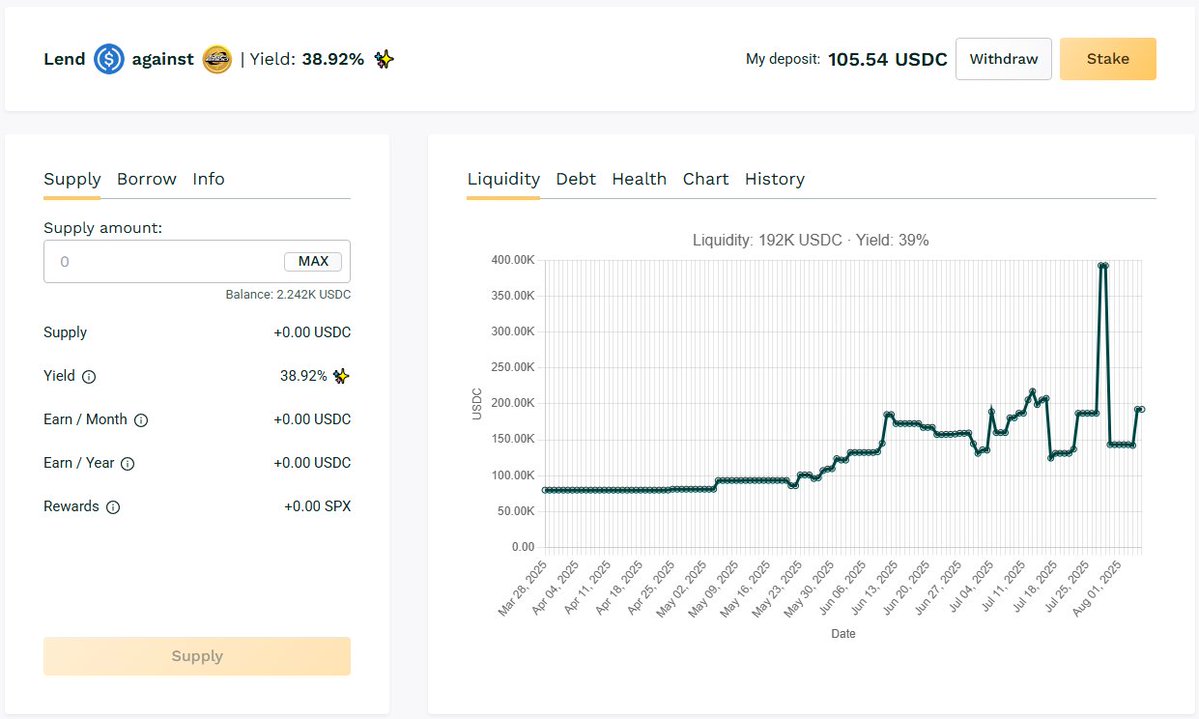

4️⃣ USDC / $SPX

🧮 APY: 38.92%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

SPX loans have maintained yields in the upper‑30% band with consistent borrower rotation.

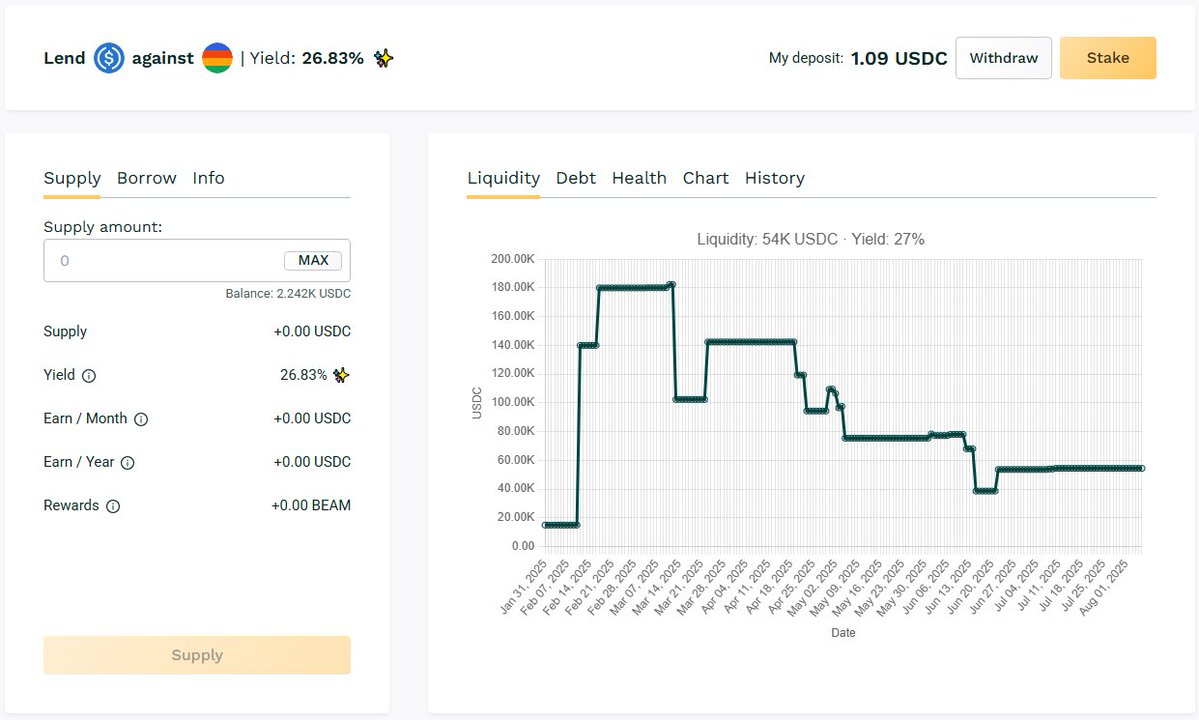

5️⃣ USDC / $BEAM

🧮 APY: 26.82%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

BEAM pool usage increased with smaller but frequent borrowing, sustaining yield near 27%.

Blue-Chip Pools

$WBTC / $USDC: 9.6%

$WETH / $USDC: 10.9%

BTC and ETH pools remained at baseline ~10% APY.

Tracking pool shifts, APY changes, and borrower activity continues next week.

Follow @useteller for more updates.

See live data →

2.16K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.